-- Africa became a niche producer as Vietnam,

Brazil expanded

-- Urbanization, staple crops a threat to African

arabica output

By Innocent Anguyo and Isis Almeida

August 2, 2017

Julien Ochala can’t

live without his morning cup of Joe.

But not just any coffee

will do. For the past five years, the 37-year-old physiology lecturer at

King’s College London has visited the same store every week to grab a pack of

his beloved Kenyan brew. And he’s not put off by the cost: at 37 pounds a

kilogram ($22 a pound), it’s more than double a similar supermarket product.

"I take Kenyan

coffee every morning," said Ochala, who buys his beans from Monmouth Coffee Company in

Borough Market. "I love it because of the relatively higher acidity level.

It keeps me active in the afternoons."

Customers willing to

pay a premium for African brews, known for their floral, fruity flavors, are

driving purchases of coffee from the continent where the drink is said to have

originated. One legend has

it that Ethiopian goat herders discovered the plant more than a thousand years

ago. Today, a cup of Kenyan coffee at Monmouth costs roughly $4, compared with

about $3 for a standard Americano from Starbucks Corp. in London.

The renewed interest

may be a blessing for farmers in Africa, where output is about three-quarters

of what it was four decades ago. Growers of robusta, the cheaper variety

favored for instant drinks, have found it hard to compete as major producer

Vietnam boosted output at much lower cost. Brazil also provided more

competition for medium-quality arabica beans.

“Ethiopian beans have

been known in the West for a long time, but now we are seeing more Rwandan,

Kenyan and even beans coming from Burundi, Uganda and Congo,” said Karl

Weyrauch, the founder of Seattle-based Coffee Rwanda, a supplier of Rwandan

beans to the American market. “African beans may also seem exotic to some

coffee drinkers and that piques their curiosity.”

But output isn’t what

it once was. In 1975, four African nations were among the world’s 10 biggest

producers. Now, only Ethiopia and Uganda make the list.

“African production is

under threat,” said Keith Flury, head of coffee research at Volcafe Ltd., one

of the world’s top coffee traders. "In countries like Kenya, Nairobi is

urbanizing fast and expanding into areas that were previously used for coffee.

In other countries such as Rwanda and Burundi, coffee is being replaced with

subsistence crops as population grows."

Younger Africans are

shunning coffee farming for more profitable careers, according to the

International Coffee Organization. It pegs the average age of an African coffee

grower at 60. Political conflicts have also made farming difficult. Nestle SA’s

Nespresso brand last year halted operations in South

Sudan due to the civil war.

In Nairobi, farmers can

make more money selling their land for property development than working the

coffee trees, said Martin Maraka, program manager at the African Fine Coffees

Association. Population growth and urbanization show little signs of slowing -

the continent will account for more than half of the world’s population growth

by 2050, adding 1.3 billion people, according to the United Nations.

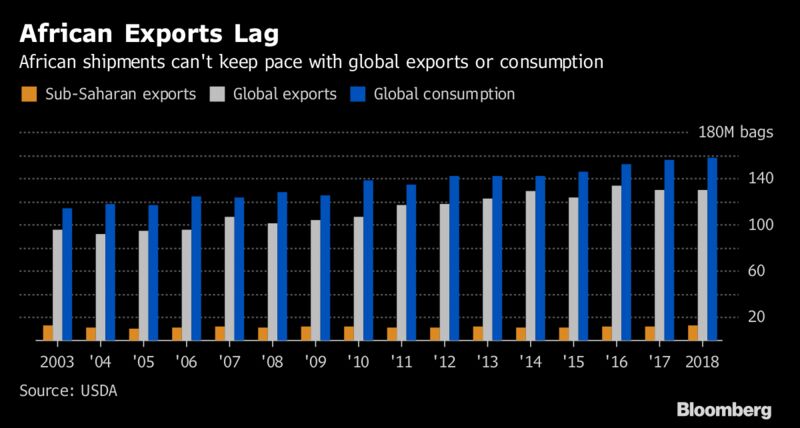

While demand is rising,

Africa’s coffee exports have mostly been flat since the early 2000s. In

comparison, global shipments jumped about 37 percent in the period as world

consumption grew by a similar amount.

Robusta coffee futures

have climbed 17 percent in London in the past year to $2,132 a metric ton.

Arabica, the type favored for specialty drinks such as those made by Starbucks,

has declined 2.3 percent in New York to $1.3805 a pound.

Demand for African

beans used in blends -- the regular products sold in supermarkets that are a

mix of supplies from anywhere in the world -- has largely been steady, and

the prospects for growth lie in so-called single-origin coffees that only use

beans from one specific place.

That potential for

niche brews is attracting trading houses to African markets, where margins are

much wider than in Brazil or Vietnam. Singapore’s Olam International Ltd., one

of the largest food merchants, last year paid $7.5 million for East

African coffee specialist Schluter S.A., which had been family-owned since the

19th century. Neumann Kaffee Gruppe, Volcafe, Louis Dreyfus Co. and Ecom

Agroindustrial Corp. are present in Africa.

Higher demand from

western consumers for some African products is evident to Lars Pilengrim, who

buys coffee for Swedish roaster Johan & Nystrom.

“The African taste

profiles are very popular in and around Scandinavia,” Pilengrim said. “We are

seeing growing interests for coffee from Africa and not only the classic

origins such as Ethiopia and Kenya. We are increasing our presence and buying

in and from Burundi.”

No comments:

Post a Comment

Join the conversation